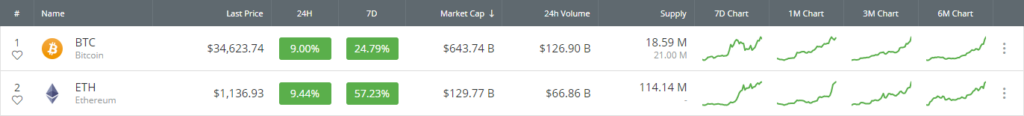

Key Highlights:

- Bitcoin saw a substantial 25% price surge this week to set a new ATH at $35,868.

- Ethereum saw a 58% price hike this week as it reached $1,140.

Bitcoin continued to set a new ATH price today at $35,868 after the cryptocurrency rallied by another 9.2%. The growth of Bitcoin over the past 3-months has been truly extraordinary after the cryptocurrency managed to rise by a robust 225%.

The market cap for the number one ranked cryptocurrency is now at $645 billion, and many expect it to hit $1 trillion by the end of 2021.

Overall, the total crypto market cap is already approaching $1 trillion itself as it currently sits at $958 billion – up almost 10% over the past 24 hours. This is mainly due to the strong BTC increase, but some cryptocurrencies are also surging much higher. For example, ADA surged over 41% today, allowing it to claim the 5th ranking position according to market cap value – pushing Ripple into the 6th position.

Additionally, Ethereum also saw a strong 10% price surge today as the cryptocurrency hits $1,136 today. The price growth of ETH has also been pretty extraordinary as it managed to climb by 58% over the past week, with a further 93% price explosion over the past month.

Let us look at the top 2 coins and provide some strong support and resistance areas moving forward.

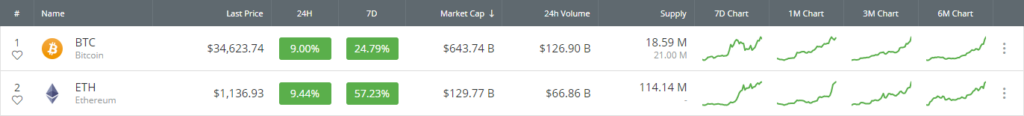

Bitcoin Price Analysis

What has been going on?

Looking at the daily chart for BTC above, we can see that the coin has come a long way since the $18,000 low seen in December. It surged higher toward the second half of the month, breaking above the $20,000 level on December 16th and setting fresh ATHs pretty much every day since!

By the end of 2021, Bitcoin had reached as high as $29,000. The coin would continue higher and break $30,000 in the first few days of January. Initially, Bitcoin found resistance at $34,800 (1.414 Fib Extension level). With the 9% price hike today, Bitcoin continued higher above this resistance to set a new ATH at $35,868. It has since dropped back beneath the resistance mentioned above at $34,800, but it is highly likely that BTC might hit $36,000 by the end of the day.

BTC price short term prediction: Bullish

Bitcoin is most certainly bullish right now. The cryptocurrency would now need to drop beneath $24,000 to turn neutral in the short term. It would have to continue beneath $18,000 (December lows) to turn bearish in the short term.

If the sellers do start pushing lower, the first level of support for Bitcoin lies at $34,000. This is followed by support at $32,640 (.236 Fib), $32,000, and $30,625 (.382 Fib). If the bears drive beneath $30,000, additional support is found at $29,000 (.5 Fib Retracement), $27,386 (.618 Fib Retracement), and $26,000.

Where is the resistance toward the upside?

On the other side, once the buyers break back above $34,800, the first level of higher resistance lies at the new ATH price at $25,686. This is followed by resistance at $36,000, $37,292 (1.618 Fib Extension), $38,000, and $38,358 (short term 1.414 fib Extension).

Beyond $39,000, added resistance is found at $39,426 (1.272 Fib Extension), $40,000, and $41,862 (1.414 Fib Extension).

Where are the technical indicators showing?

The RSI is extremely overbought, suggesting that the buyers might be a little overextended and in need of a retracement. Additionally, the Stochastic RSI recently produced a bearish crossover signal, which could suggest an imminent pullback.

Ethereum Price Analysis

What has been going on?

Likewise, Ethereum has seen explosive growth since the start of 2021. It pushed higher above $750 at the start of the year and continued to surge higher. Along the way up, it met resistance at $975 (1.272 Fib Extension), $1,042 (1.414 Fib Extension), and $1,100 (yesterday closing price) until reaching the $1,166 high today (1.618 Fib Extension).

We can see that it has dropped lower slightly and is trading at the $1,133 resistance – provided by a bearish .786 Fibonacci Retracement level.

ETH price short term prediction: Bullish

Ethereum is strongly bullish right now. The coin would need to drop back beneath $700 to turn neutral and would have to fall further beneath $500 to be in danger of turning bearish in the short term.

If the sellers push lower, the first level of support lies at $1,100. This is followed by support at $1,042 (1.414 Fib Extension), $1,000 (.236 Fib Retracement), and $975 (1.272 Fib Extension). Beneath $975, support lies at $905 (.382 Fib Retracement), $826 (.5 Fib Retracement), $800, and $750 (.618 Fib Retracement).

Where is the resistance toward the upside?

On the other side, if the buyers climb beyond $1,133 (bearish .786 Fib Retracement), the first level of resistance lies at $1,166. Following this, resistance lies at $1,200, $1,266 (bearish .886 Fib Retracement), $1,295 (1.272 Fib Extension), and $1,300.

If the buyers bring Ethereum above $1,300, resistance is located at $1,358 (1.414 Fib Extension), $1,400, $1,450 (1.618 Fib Extension), $1,500, and $1,550 (1.618 Fib Extension – orange).

Where are the technical indicators showing?

Both the RSI and Stochastic RSI are extremely overbought, suggesting that the buyers might be a little overextended and need a retracement.